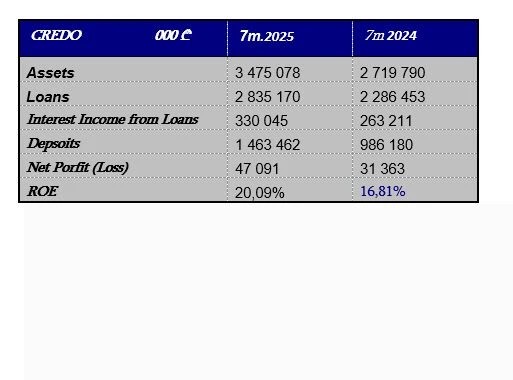

Tbilisi (GBC) – Liberty Bank has dropped out of the TOP-3 most profitable banks, and its place as a systemically important bank was taken by Credo Bank, a former microfinance organization (MFO).

Credo closed the first seven months with a return on equity (ROE) of 20.09%, moving up to 3rd place. Last year, it held 4th place with an ROE of 16.8%.

|

List of Shareholders owning 1% and more of issued capital, indicating Shares |

|

|

Access Credo GmbH (Germany) |

50,3% |

|

Gojo & C0mpant Inc. |

16,7% |

|

Societe de Promotion et de Participation pour la Cooperation Economique (Proparco) |

14,7% |

|

Triodos Custody B.V., Triodos Fair Share Fund (Netherlands) |

8,3% |

|

Triodos SICAV II, Triodos Microfinance Fund (Luxembourg) |

8,3% |

Japanese Gojo & Company Becomes New Shareholder of Credo Bank. Gojo & Company, a Japanese investment firm, became a new shareholder of Credo Bank at the end of last year.

The National Bank of Georgia (NBG) announced the deal in a press release and also hosted Credo shareholder Taejun Shin during the celebration of the 30th anniversary of the Georgian Lari.

While Credo did not surpass Liberty Bank in net profit to claim third place, it still made it into the top five with a profit of GEL 47.09 million, behind Liberty (GEL 73.6 million) and Basisbank (GEL 59.5 million). According to January–July data, Bank of Georgia (GEL 922 million) and TBC Bank (GEL 685.6 million) continue to hold the 1st and 2nd positions respectively. As of August 1, 15 out of 19 banks in Georgia were operating profitably, with a total combined profit of GEL 1.826 billion.