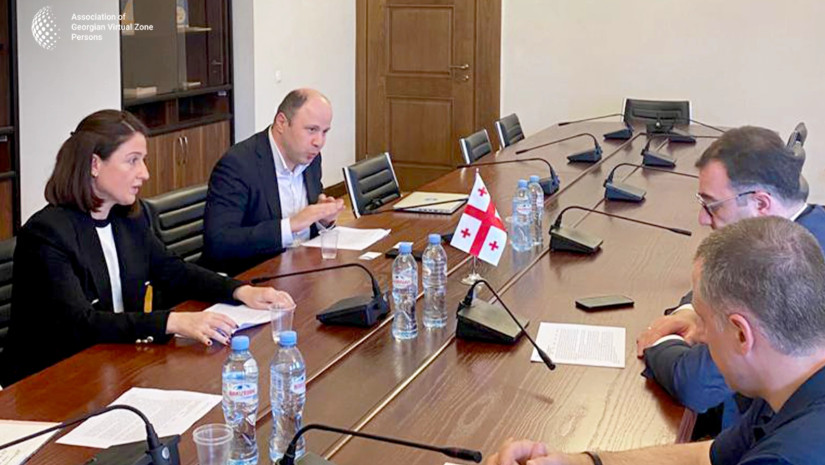

Tbilisi (GBC) - defining the legislation related to the taxation of companies with Virtual Zone status, establishing a fair and transparent tax policy, and clarifying the relevant legislation were the main issues of the meeting held in the Parliament, which were discussed by David Songhulashvili, the chairman of the sectoral economy and economic policy committee, and Shorena Kopaleishvili, the chairman of the Association of Georgian Virtual Zone Persons.

The mentioned issues became relevant after hundreds of international and local IT companies attracted to the country by tax incentives faced fine sanctions imposed by the representatives of the Revenue Service. We are talking about the ambiguity of the legislation adopted in 2011, which, according to the Association's chairman, Shorena Kopaleishvili, allows authorities to interpret it in order to fine businesses. We are talking about the multimillion-lari fines imposed on companies that have benefited from tax breaks in recent years.

Nino Ushikishvili, the deputy director of the European Business Association, who advocates for the VZP industry, and David Papiashvili, the author of the legislative initiative, and the managing partner of the international network company Kreston Georgia, were involved in the meeting held in the parliament.

Shorena Kopaleishvili emphasizes the importance of G2B meetings in her conversation with us, hoping that they will reconcile positions with the committee on issues of improving legislation at the meeting scheduled for next month.

"First and foremost, I would like to thank Mr. David Songhulashvili, chairman of the Parliament of Georgia's sectoral economy and economic policy committee, and his staff for their prompt response and interest in the topic." During the meeting, we shared our suggestions and opinions with Mr. David, one of the active and leading committee chairman, who understands the role of small and medium businesses in developing the country's economy, especially regarding information technology and innovation. We discussed the various legal aspects of the proposed legislation, its feasibility, and the urgency with which the issue must be resolved. We received the readiness of the legislators that the committee will start studying the document initiated by us, and we will reconcile the positions in the current month", – says Shorena Kopaleishvili.

The chairman of the Association also attaches great importance to the position of the Ministry of Finance concerning the legislative initiative. Before that, the Association held several meetings with the representatives of the agency on issues of transparency and refinement of the legislation.

"We must mention that the position of the Ministry of Finance of Georgia regarding these issues is important, which I think we will find out shortly. We hope that this meeting will be productive and that we will be able to achieve results together. We have positive expectations", – says Shorena Kopaleishvili.

In an interview with GBC.GE, Nino Ushikishvili, Deputy Director of the European Business Association, stated that some progress has already been made in the process of advocating for the VZP industry and that some fine sanctions caused by ambiguity in the legislation have been fully or partially canceled.

"It is especially welcome that the changes implemented as a result of cooperation in the advocacy process were simultaneously reflected in practice. In particular, several member companies had an ongoing dispute, and by using the third methodological reference newly adopted by the Revenue Service, it was possible to completely/partially cancel the fines imposed on them", – says Nino Ushikishvili.

According to her, improving the regulatory legislation of the VZP industry is even more important than protecting the interests of specific companies, and this means improving the investment environment in the country.

"Even if we consider the issue from an investment point of view, taking into account the background created by the fines imposed on VZP persons and the frequent changes of views/approaches in the recent period, the refinement of the legislation and more predictability are fundamentally important in terms of supporting the information technology industry for the strategic positioning of the country and the formation of an attractive investment environment", - explains Nino Ushikishvili.

Despite the numerous issues that existed and continue to exist in the field of VZP taxation, and despite the fact that hundreds of companies with VZP status were unfairly fined by the Revenue Service (in the opinion of industry and experts), it can be stated that these companies continue to operate in Georgia, hoping for a successful future. According to Shorena Kopaleishvili, they contribute significantly to the development of the country's economy, as well as the introduction of new technologies and the process of transforming the country into an information technology hub.

Despite the numerous problems and challenges, she claims that VZP companies have made a significant contribution to our country's development in all directions, namely:

1. VZP companies in Georgia paid more than 70 million GEL in taxes between 2011 and 2022.

2. Hundreds of Georgian citizens are employed in VZP companies.

3. VZP status has been granted to over 1,000 companies. Their arrival in Georgia was accompanied by an influx of vast experience and knowledge in the mentioned field, as well as multi-million investments into our country, which gave an additional impulse to the development of Georgia.

Based on the above, the association team believes that the regulatory legislation in such a promising field for the development of Georgia should be formulated and spelled out in the relevant legislative acts and should not allow for misinterpretation by the Revenue Service.

All details of the taxation of companies with VZP status should be spelled out in the Tax Code of Georgia and the relevant regulatory legislation, not in Revenue Service methodological references or so-called situation manuals, which are internal instructional documents.

According to Shorena Kopaleishvili, if the main principles related to the taxation of VZP companies are not regulated by current legislation, there is always the risk that the companies will find themselves at the forefront of a new wave of fines.

In her opinion, that is why it is necessary to make changes and additions to such legislative acts as:

1. Tax Code of Georgia

2. Law of Georgia on Information Technology Zones

3. By-law normative acts regulating the field of VZP